By Don and Patrice Lewis

In 1993, shortly after we got married, my husband and I took a leap into the unknown. We left urban California, left our jobs, left our families, and settled in a small fixer-upper on four acres in southwest Oregon. There we started a home woodcraft business, had our children, and flirted with homesteading. During this process, we plunged into an unimaginably low income bracket. It was only through extreme frugality and careful money management that we were finally able to poke our heads out of the financial hole we had dug for ourselves.

Ten years later, in 2003, we took our decade of hard-knocks education and upgraded to a larger home on 20 acres in north Idaho. Here we continued our woodcraft business, raised and homeschooled our daughters, and launched full-fledged into self-sufficient homesteading. Frugality became a way of life, and both our children and our homestead thrived.

Our homestead in Idaho, 2004

Today, 16 years after relocating to Idaho, with our children grown and out of the house, my husband and I are selling our homestead (www.ruralrevolutionhomestead4sale.blogspot.com) and looking to move to a smaller place. Yes, we’re starting over. Some people think we’re crazy to embark on a new escapade at our ages (57 and 62), but we like adventure and we’re looking forward to new challenges. We’re also looking for a place we can buy with cash and eliminate a mortgage.

But one thing will go with us as we search for a new home: frugality. In fact, as we get older, we’re still working on paring down any and all extraneous expenses. Currently, excepting our modest mortgage, our monthly bills (excluding food and other variable purchases) are approximately $600/month. Any surplus income is banked for the future.

Looking back from our (cough) “vast” experience from over a quarter-century of small-time farming, we realize we did some things right — and we did some things wrong. Profit from our wisdom.

What we did wrong

- Early on we got into debt. This is so easy to do, especially when your income streams are irregular (as with a woodcraft business). Money is tight but you need to purchase X, so it goes on the credit card. One of the reasons I’m so fearful of debt today is because we spent so many years mired in it. I can’t emphasize this strongly enough: Stay out of debt.

- We delayed for too long on certain big purchases. Having just admitted debt is dangerous, there are times it’s necessary to borrow money for efficiency, safety, or health. For us, the two things we put off too long were a barn and a tractor. The reason we delayed is obvious: they cost a lot of money. In fact, we should have prioritized our finances to swing these purchases earlier — it would have simplified our lives dramatically, saved a lot of wear and tear on our bodies, and increased the comfort of our animals. This is when you might want to talk with your local banker to arrange financing and take a plunge.

In the case of a barn (a 36×48-foot pole building), there were three reasons we thought it necessary:

- to provide shelter for our livestock in winter

- to protect the hay we needed to feed them

- to build ancillary structures such as an awning, feed boxes (to reduce hay wastage), a bull pen shelter, etc.

A barn and a tractor are two big investments we wished we had made sooner.

To save costs, we literally had the contractors build nothing but a roof on stilts, and we finished the rest of the barn ourselves with scavenged materials. It was far more affordable that way.

The second big purchase was a tractor. Much of building a homestead involves heavy lifting, so having a force-multiplier is critical. Early on, we made the mistake of purchasing a 1947 Ford 8N tractor (because it was cheap). For six years my husband tried to keep it running, and for six years it mostly sat idle until at last it graduated to the status of lawn ornament. It took us until 2015 (12 years after moving here) to get smart, borrow the money, and purchase a new 35-horsepower beast.

It would not be an exaggeration to say this tractor allowed us to make the final push into a truly self-sufficient homestead. The amount of wear and tear on our increasingly older bodies as we lifted, shoved, pushed, carried, plowed, rototilled, transported, wheeled, and trundled through endless tasks without machinery (or with borrowed machinery) means we can now get more done with less effort and keep our bodies from breaking down. We should have done this years ago. It was one of the best purchases we ever made.

- We scrimped on fencing. There was once a (very brief) time when we believed three strands of barbed wire would keep in a bull. Livestock is incredibly tough on fencing. It’s far better to over-build (even though initially it costs more) than under-build. If we’d built strong, sturdy, appropriate fences from the start, we could have saved a huge amount of stress and aggravation — not to mention money. (Our feed lot and bull pen are now constructed of railroad ties sunk in the ground, four levels of 2x6s bolted to the ties, and a double strand of hotwire. Most of the time this works to keep the bull in his place.)

- We ignored what the soil was telling us. It took us nine years of garden failures to understand our heavy clay soil was too tough for vegetables. (Interestingly, if we’d had a tractor during this period, we might have succeeded by plowing in massive amounts of compost and sand, but we had no way to do this.) We finally realized the definition of insanity was doing the same thing over and over and expecting different results, so we abandoned the ground and started gardening in raised beds (tractor tires). The difference was night and day, and we became nearly fully self-sufficient in fruits and vegetables within two years of tire gardening.

Good fencing is important. Wooden “droppers” can strengthen fencing.

It took us nine years to realize that gardening in tires was the way to go.

What we did right

- We didn’t buy bare land. When we moved to Idaho in 2003, we brought with us two young children and a home woodcraft business. Our children needed shelter, and our business needed a place to set up so we could earn a living. We had neither the time nor money to build a homestead from the ground up, so we settled on a place that had a fixer-upper house and shop building already in place.

In retrospect — and having since watched neighbors start with bare land — it was one of the smartest things we did. Bare land is often seductively low in price, but it’s astounding how fast the costs skyrocket — drilling a well, bringing in power (or installing off-grid options), building a habitable home and outbuildings, etc. Additionally, the unfortunate-but-true stereotype of getting hinterland contractors to show up in a timely fashion caused many of these neighbors to go bald from all the hair-pulling.

Our woodcraft business is just one of our “irons in the fire.”

Living a frugal lifestyle does not make us feel deprived.

The sad truth is most people simply run out of money and spend years living in half-finished conditions. We have neighbors who, 16 years after moving onto their land, are still living with studs and no outbuildings. Others spend years living in a “temporary” single-wide next to their vapor-barrier-sheathed, but still uninhabitable “dream” home.

Twice now, we’ve bought beautiful properties with fixer-upper homes, and both times we were able to significantly increase the value through sweat equity. We plan to do the same thing in our new home, wherever it may be.

- We developed work-at-home income sources (mostly our woodcraft business, but also freelancing in other spheres). When we first moved to rural Oregon in 1993, fresh from the city, the importance of working from home didn’t occur to us until later. All we knew is we couldn’t find jobs and we were desperate to earn money. But over the intervening years, we realized the benefits of home-based income. By working from home, you save yourself commuting time and costs, and — arguably more important — you can purchase property farther away from urban hubs where prices are lower.

- We have multiple income streams (what I call “many irons in the fire”). The idea is if one source of income dries up, we have other resources we can fall back on. For example, we had a wonderful shared full-time online job which lasted about five years and paid generously. Then one day, zip! it was gone, without any warning. Because we had other irons in the fire, we adjusted without a problem. To this end, we’re always on the lookout for additional irons. Each iron doesn’t have to be very big, and many small income streams can add up to a livable income.

- We learned the art of frugality. People spend an astounding amount of money trying to impress others with their home, car, clothes, jewelry, electronics, furnishings, etc. Because we’re totally indifferent to conventional status symbols, most of our possessions are either second-hand or homemade. In the case of electronics, we keep our ownership to the necessities (two computers and one “dumb” phone is the sum total). We don’t — ever — recreationally shop. We always look for ways to trim expenses. This is all so second-nature now that we don’t give it much thought. The last thing we feel is “deprived” as a result of frugality.

- We didn’t overextend ourselves financially for our mortgage. A major advantage of working from home is we could live anywhere, so we concentrated on places where property prices were lower. It took three years of careful searching (in several states) before we found a home on 20 acres we could afford on a woodcrafter’s income. We knew our income was not likely to increase by much, so we had to be able to afford the mortgage at its current level. This is a point that can’t be underscored enough: don’t overextend yourselves financially when it comes to a mortgage.

We learned stout fencing was necessary to keep the livestock contained.

We learned to lay in plenty of firewood for the winter months.

- We homeschooled. I won’t discuss the benefits of educating one’s children at home in terms of quality and values. Instead, consider this: Homeschooling allows you to live further away from urban hubs, with the more remote properties being generally cheaper. It’s well documented that home prices are higher in better school districts. We could completely disregard the quality of the local school district and instead concentrate on the quality of the homestead.

- We were willing to roll with the punches and learn from our mistakes. It seems a lot of people either give up too soon, or get overly frustrated by mistakes. Failure is just part of homesteading. When a heifer lethally injured herself on a piece of overlooked sheet metal, we learned never to leave sheet metal lying about. When fences failed and the livestock went merrily cavorting across the neighbor’s land, we learned to build stronger fences. When we got caught short on firewood in late spring, we learned to lay in more firewood each fall. When our in-the-ground garden performed poorly, we learned to grow in raised beds.

- We clubbed up. Not only did we develop excellent relations with our neighbors — one of our greatest blessings — but we joined local organizations in town. By joining a church, a fraternal organization, the Chamber of Commerce, or other local groups, you can meet the movers and shakers in the community as well as learn about local politics. And that’s important. Your single voice in a rural location is much more powerful than it would be in an urban locale. Most folks in a large city will never meet their mayor. In the country, it’s not unusual for you to buy your hay from the county commissioner or pass the church collection plate to the sheriff. (You can also find out which local contractors have the best reputations.) The faster you become a part of the community, the better; and the fastest way to do so is membership in the hallowed organizations that populate every rural town.

- We bought tools. Some of these tools are large (tractor + implements, log splitter), some are medium (chain saw, pressure canner), some are small (garden implements, hand tools), but all are necessary. The right tools are not just more efficient, they’re a huge factor in our health and safety. If we need to split wood for the winter, a chainsaw and log splitter saves wear and tear on our bodies and makes the job much faster, easier, and safer. We purchase the best-quality tools we can afford and take care of them.

- We kept our eyes on the prize. From the beginning, our homesteading goal was food self-sufficiency. Since money was always tight, we had to ask ourselves if spending money on X would apply toward our long-term goals. The answer was “no” if the purchase was new clothes and restaurant meals. The answer was “yes” if the purchase was a pressure canner or T-posts.

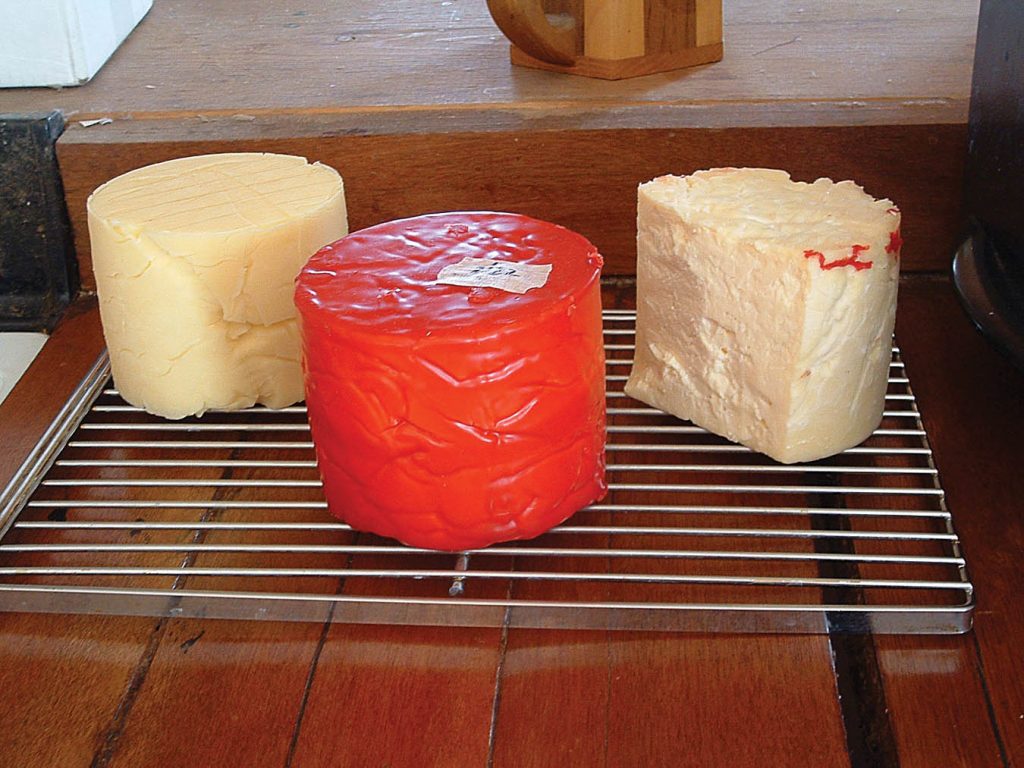

Animal husbandry, carpentry, canning, and cheesemaking are important homesteading skills.

- We got our livestock early. Sometimes this backfired — occasionally we had to hurriedly build infrastructure and shelters after the fact — but by plunging into animal husbandry, we irrevocably committed ourselves to striving toward that goal of food self-sufficiency.

- We learned skills. It’s often far more affordable to do things yourself than to pay or hire someone to do them for you. Carpentry, wiring, plumbing, milking, cheesemaking, canning, sewing, welding, gardening, animal husbandry … the list of rural skills is endless. Be willing to learn and experiment. Everything you can do yourself is something you’ll have forever. However, it’s also important to know when hiring an expert is actually more intelligent than winging it. When we built our barn, we had the option of buying a kit and doing it ourselves, or having the barn installed by experts. We opted to have the builders put in the poles and roof, because one out-of-alignment post can really ruin your day (or year). We added the girts, sheathing, and additional infrastructure ourselves.

- We transitioned to an all-cash lifestyle several years ago and liked it so much we never went back. This has a number of benefits: It keeps us within a budget (if we can’t pay cash, we can’t afford it); we don’t leave annoying “cyber trails” whenever we conduct errands in the city; and, last but not least, we avoid the increasingly numerous data breaches happening in so many retail establishments. We have no automatic payments of bills (except our mortgage), so we pay utilities by check. Every other purchase — every single one, big or small — is done with cash. We so seldom use a credit card that I’m always flummoxed by how to slide the durn thing through a card reader in a store.

To save money we added the girts and sheathing to the barn ourselves.

What we plan to do on our new homestead

As I write this, we do not yet know where our new homestead will be, but we’ve talked endlessly about the possibilities. Based on our past experiences in two different rural locations, here are some of the things we plan to do in our next place:

- Stay out of debt. Without a mortgage, a large chunk of our income will be freed up, which we can then set aside for retirement, medical expenses, or other contingencies.

- Continue to live frugally. We’re long past the stage where we’re trying to impress anyone with our possessions, which means we’re happy to continue living a simple, frugal life.

- Take our tools with us. Having acquired a solid inventory of homesteading implements and equipment, we don’t need to repeat these purchases in our new home.

- Take our skills with us. My husband is so “handy” that we’re not afraid to tackle another fixer-upper — within reason and keeping in mind we’re getting older. Ideally this means we can purchase a less expensive place, fix it up to our satisfaction, and bank the profit from the sale of our current home.

- Concentrate on developing the necessary homesteading infrastructure: fencing, outbuildings, chicken facilities, fruit trees, milking stall, garden, watering system, and all the other improvements we spent 16 years learning how to do here at our current home. We have many small tweaks and improvements we hope to make.

- Continue laying financial irons in the fire. What kind of at-home projects will earn us money? Perhaps we could write and sell more e-books. Perhaps we could do farmer’s markets or craft fairs. Perhaps we could develop more woodcraft products for sale. The sky’s the limit.

- Meet our neighbors and get involved in local community organizations. Having friendly neighbors is a huge benefit in the country. These are people you can turn to for help, guidance, friendship, meals, and celebrations. Getting involved in the nearest community through church, civics organizations, or fraternal organizations will allow us to meet the movers and shakers in our new town.

- We intend to enjoy ourselves. We don’t live a self-sufficient lifestyle out of fear or duty; we do it because we love it. With our children grown and on their own, my husband and I look forward to quiet evenings on the porch or in front of the woodstove, drinking a glass of wine and enjoying each other’s company, discussing a new project or what we might do differently next time. Someday we’ll welcome sons-in-law and grandchildren as well.

- We intend to keep homesteading for as long as we can. Right now we’re blessed with good health, and I believe part of that stems from the happy, low-stress lifestyle we’ve chosen. Wouldn’t it be something to live the remainder of our lives milking cows and canning blueberries?

Suggestions for first-time homesteaders

- Don’t buy bare land unless you have a lot of time, a lot of money, and a lot of skills to create a homestead from scratch. Above all, be realistic about that time, money, and abilities. Consider purchasing a fixer-upper existing home and making improvements over time, instead of starting from scratch. You can always trade up to a bigger place later on.

- Be willing to start modestly. Don’t expect a “perfect” homestead from Day One. It takes time! Put in sweat equity rather than hiring out stuff that needs doing.

- Acquire skills — carpentry, food preservation, animal husbandry, etc. No matter what happens, those skills — once learned — will never leave you.

- Stay out of debt and don’t overextend yourself financially. Enough said.

- Look for ways to work from home, even if it’s small part-time stuff to start with. Lay multiple income-producing irons in the fire whenever possible.

- Become friendly with your neighbors (if possible). Good neighbors are a huge blessing.

- Be willing to fail. At least you tried, right? And now you’ve acquired some wisdom about what went wrong. Failure can be the best teacher.

- Overcome your fears. Sometimes the only way to tackle a project is to just grit your teeth and do it. (That’s how we got our first cow. And for that matter, our first kid.)

- Have fun! You’re in this partly for the adventure. Keep a sense of humor. Sometimes even bad days can make you smile down the road.

Great experience! Well done. It’s good that you share your experience with newbies. Excellent magazine. Interesting articles! Go on! Good luck!

This was an excellent article. Gave confirmation that we are doing a lot right. But certainly learned we could do some things better. There is nothing like homesteading and we wouldn’t trade it for anything! Thank you BWH for providing great reads, tips and ideas!

Good informative article. I liked it.

What a wonderful, insightful article. Appreciate all that you shared — I read bits of it to my husband just now. Two years ago we settled on our place and it’s been a wonderful learning curve. Expecting to get our pregnant Alpine goat next month so that I can branch out into cheese (and maybe soap?) making.

I wish this article had come just a bit sooner! Having just purchased 156 ac of raw land in April, my shop is built (we will have full hook-ups for our RV under the awning while we build our home), but here it is 3/4 through November and I’m still lacking the last piece…finishing my water well. I’m encouraged by the suggestions of “good” investments – I’ve been struggling with the decision of whether or not to extend enough to purchase a good tractor vs getting a less expensive one. I’m not dependent on the income produced on our homestead for a living, but the trade off is the time constraints created by my regular job (I hope to create income streams to one day let it go). This article, while not the most timely for me, was excellent. I love everything about BWH. Thank you!