Page Not Found

Sorry! The page you were looking for is no longer available or the link has expired. If you were looking for a specific product, you can search our store.

While you’re here, take a look through some of our great articles!

Raising cattle on your own place

By Charles Sanders

Issue #85 • January/February, 2004

Winter won't last forever. It won't be long before spring will arrive and pastures will start to green...

Okra — Not Just for the South

By Alice B. Yeager

Photos by James O. Yeager

Issue #58 • July/August, 1999

No one is quite sure about how okra seeds came to this country....

An Introduction to Small-Scale Home Hydroponics

By Ben Richards

Issue #154 • July/August, 2015

As most people are already aware, hydroponics is the practice of growing plants without soil. This is done...

Green or Yellow: Grow Your Best Bush Beans Ever

By Lisa LaFreniere

Issue #62 • March/April, 2000

Bush Beans, or snap beans as they're sometimes referred to, are a growing favorite among many gardeners, and...

By John Silveira

Issue #119 • September/October, 2009

Gun control people don't seem to get just how deeply etched into the American psyche gun ownership goes and that the resistance to being disarmed by their own government runs even deeper.

Private arms have been confiscated from the populace in almost every other...

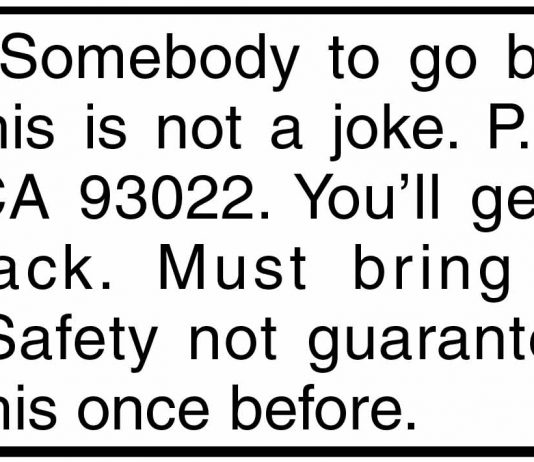

By John Silveira

Issue #125 • September/October, 2010

It's become a minor Internet phenomenon. The ad reads:

It's also been read by Jay Leno on his late night TV show, on National Public Radio more than once (including Car Talk), on craigslist.org (sans the P.O. box), it's been printed on T-shirts, discussed...

By Don Lewis

Issue #176 • April/May/June, 2019

The year was 1834, a year that didn’t really stand out as all that particularly important in American history. But like any other year, it had its share of firsts. The first railroad tunnel was completed in Pennsylvania and the United States Senate...