Page Not Found

Sorry! The page you were looking for is no longer available or the link has expired. If you were looking for a specific product, you can search our store.

While you’re here, take a look through some of our great articles!

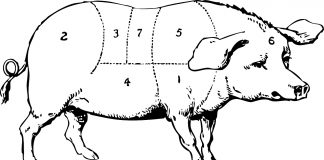

How to butcher a chicken in 20 minutes or less

...while leaving the carcass and feathers intact!

By Dr. Roger W. Grim, D.C.

Issue #79 • January/February, 2003

Figure 1. With a trash bag properly fitted around...

Grow Your Own Dishrags

By Alice B. Yeager

Photos by James O. Yeager

Issue #85 • January/February, 2004

Some of us are thrifty beyond measure, even growing our own dishrags. None...

The Best City Garden

By Anita Evangelista<!--

The best city garden

By Anita Evangelista

-->

Issue #103 • January/February, 2007

City gardens and country gardens are differentnot only in the amount of space...

Build a Keyhole Garden

By Katelynn Bond

Issue #152 • March/April, 2015

One of the hazards of living on the side of a mountain in northern New Mexico is that...

By John Silveira

Issue #119 • September/October, 2009

Gun control people don't seem to get just how deeply etched into the American psyche gun ownership goes and that the resistance to being disarmed by their own government runs even deeper.

Private arms have been confiscated from the populace in almost every other...

By John Silveira

Issue #60a • November/December, 1999

"The election's next year, right?" I asked.

Dave Duffy, the publisher of Backwoods Home Magazine, was editing a rather lengthy article on water. I don't know if he didn't hear me or just didn't realize I was talking to him. He didn't say anything,...

By Robert L. Williams

Issue #19 • January/February, 1993

Many years ago, before I came to my senses and left public education for good, I was teaching on a college campus when one of the administrators approached me and asked the topic of my lecture that day.

"Tom Paine and the Rights...