Page Not Found

Sorry! The page you were looking for is no longer available or the link has expired. If you were looking for a specific product, you can search our store.

While you’re here, take a look through some of our great articles!

Finding the best dog for the country life

By Anita Evangelista

Issue #63 • May/June, 2000

When you're looking for a dog to fit into your country life, there are few other topics as...

Raised Bed Gardening — Neat and Productive

By Alice B. Yeager

Issue #74 • March/April, 2002

Are you tired of raising a big row crop gardenone that keeps you busy from dawn until...

Herb Boxes from Fence Boards

By Maggie Larsen

Issue #86 • March/April, 2004

During a binge of spring cleaning, I ventured outside and began to renovate the exterior of my home,...

No Worrying About Fire Blight with Orient and Kieffer Pears

By Alice B. Yeager

Issue #52 • July/August, 1998

Everyone likes a good success story, and if I were called upon to name the most successful...

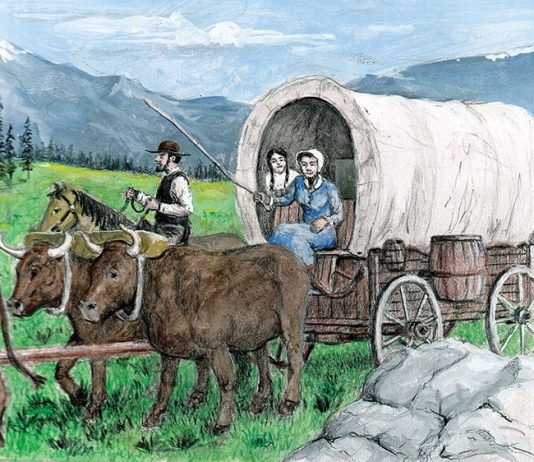

We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity, do ordain and establish this Constitution for the United...

By Don Lewis

Issue #176 • April/May/June, 2019

The year was 1834, a year that didn’t really stand out as all that particularly important in American history. But like any other year, it had its share of firsts. The first railroad tunnel was completed in Pennsylvania and the United States Senate...

By Martin Waterman

Issue #37 • January/February, 1996

I can remember taking a trip as a child and seeing my first Burma Shave signs. Technically speaking, after 1963 all the 7,000 or so sets of signs were supposed to have been taken down. Still, my discovery may not have been unusual,...