Page Not Found

Sorry! The page you were looking for is no longer available or the link has expired. If you were looking for a specific product, you can search our store.

While you’re here, take a look through some of our great articles!

Get to know your spiders

By Jerry Hourigan

Issue #109 • January/February, 2008

Every landowner and homeowner creates the perfect environment for spiders. Not intentionally, of course, but spiders seem to...

Rotten Luck: The Skinny on Composting

By Patrice Lewis

Issue #141 • May/June, 2013

For much of human history, people have tried to prevent things from rotting. Literally every food preservation method...

Saving Seeds

By Jackie Clay

Issue #129 • May/June, 2011

I go through dozens of garden seed catalogs in preparation for each year's new (and better!) garden. I...

Build a Composter

By Charles Sanders

Issue #170 • March/April, 2018

As with most of the other facets of homesteading, composting can be as simple or as elaborate as...

Friends and Fellow Citizens: The period for a new election of a citizen, to administer the executive government of the United States, being not far distant, and the time actually arrived, when your thoughts must be employed in designating the person who is to be clothed with that important...

By John Silveira

Issue #125 • September/October, 2010

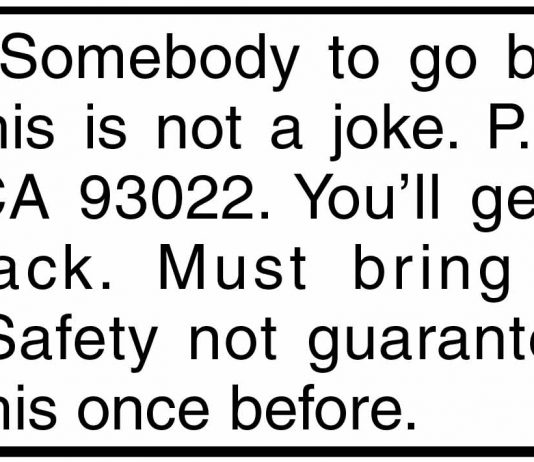

It's become a minor Internet phenomenon. The ad reads:

It's also been read by Jay Leno on his late night TV show, on National Public Radio more than once (including Car Talk), on craigslist.org (sans the P.O. box), it's been printed on T-shirts, discussed...

By O. E. MacDougal

Issue #154 • July/August, 2015

There was a time when it was thought that a defining difference between humans and animals was: we use tools, they don't. But, in the last few decades, it's been discovered that many animals are tool users.

Before we go further, let's define...