Page Not Found

Sorry! The page you were looking for is no longer available or the link has expired. If you were looking for a specific product, you can search our store.

While you’re here, take a look through some of our great articles!

Khaki Campbell ducks — The other egg layer

By Amanda J. Kemp

Issue #126 • November/December, 2010

Spring brings the pitter-patter of little feet in the mud, games of tag, and raucous quacks. While...

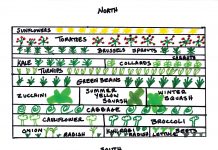

Gardening Tips and Tricks

By Charles Sanders

Issue #99 • May/June, 2006

Gardeners are an ingenious lot. Trial and error, time, study, observation, and experience all help us to come...

Tea for the garden

By Lisa Nourse

We have poor soil and do our best to amend it with compost and manure every year. However, we feel our plants...

Seven tactics for planning next year’s garden

By Kristina Seleshanko

There are few things I enjoy more than snuggling up next to the woodstove with a cup of coffee and my garden...

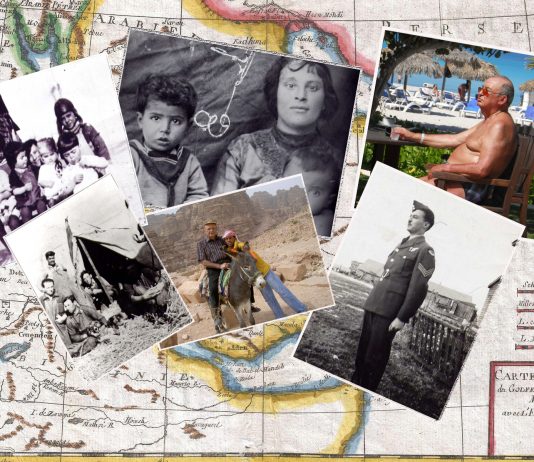

Habeeb Salloum, 95, a poet, world traveler, linguist, and author of recipe books on Middle Eastern cuisine, has written recipe articles for Backwoods Home Magazine for 19 years. The son of Syrian immigrant farmers, he lives in a small town near Toronto, Canada.

By Habeeb Salloum

Website Exclusive • August, 2019

In...

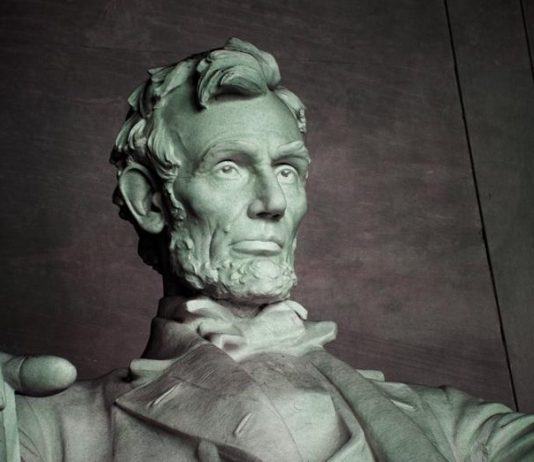

By the President of the United States of America:

A PROCLAMATIONWhereas on the 22nd day of September, A.D. 1862, a proclamation was issued by the President of the United States, containing, among other things, the following, to wit:

"That on the 1st day of January, A.D. 1863, all persons held as...

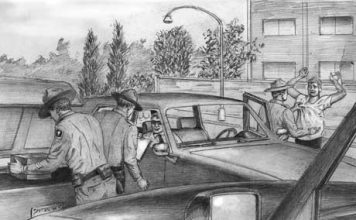

By John Silveira

Issue #60a • November/December, 1999

"The election's next year, right?" I asked.

Dave Duffy, the publisher of Backwoods Home Magazine, was editing a rather lengthy article on water. I don't know if he didn't hear me or just didn't realize I was talking to him. He didn't say anything,...