Page Not Found

Sorry! The page you were looking for is no longer available or the link has expired. If you were looking for a specific product, you can search our store.

While you’re here, take a look through some of our great articles!

Bovine basics for beginners

By Patrice Lewis

Issue #122 • March/April, 2010

Congratulations. You've escaped the city life and are now the proud owners of your little plot of rural...

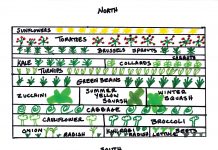

Seven tactics for planning next year’s garden

By Kristina Seleshanko

There are few things I enjoy more than snuggling up next to the woodstove with a cup of coffee and my garden...

Caring for your chickens in winter

By Jackie Clay-Atkinson

As winter approaches, we all are thinking of ways to make our livestock and poultry as comfortable as possible when the cold...

Mid-season planting

By Jackie Clay-Atkinson

As the saying goes “Life happens…” Maybe events have kept you from getting your garden planted early in the spring. When we...

By Marjorie Burris

Issue #57 • May/June, 1999

My grandmother, Mary Etta Dillman Graham, was one of those frontier women who took life as it came; extremely practical, resourceful and inventive, she was always, always ready to help other women. True to her time and her own modest nature, she never...

By Martin Waterman

Issue #37 • January/February, 1996

I can remember taking a trip as a child and seeing my first Burma Shave signs. Technically speaking, after 1963 all the 7,000 or so sets of signs were supposed to have been taken down. Still, my discovery may not have been unusual,...

By John Silveira

Issue #119 • September/October, 2009

Gun control people don't seem to get just how deeply etched into the American psyche gun ownership goes and that the resistance to being disarmed by their own government runs even deeper.

Private arms have been confiscated from the populace in almost every other...