Page Not Found

Sorry! The page you were looking for is no longer available or the link has expired. If you were looking for a specific product, you can search our store.

While you’re here, take a look through some of our great articles!

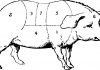

Hog butchering — Using everything but the squeal

By Charles Sanders

Issue #142 • July/August, 2013

A 450-pound hog will provide a lot of delicious meat.

Hogs are raised throughout our neighboring Amish community for...

A Small Space Yields a Big Crop of Garlic

By Howard Tuckey

Issue #131 • September/October, 2011

In less than an hour last fall, I tilled up a 4x8 foot garden bed and planted 250...

You Can Make Your Own Fertilizers

By Christopher and Dolores Lynn Nyerges

Issue #44 • March/April, 1997

For some people, home gardening is an expensive pursuit, which seems a bit backward to...

Growing and Using Peppers

By Jackie Clay-Atkinson

Issue #164 • March/April, 2017

I’ve been growing peppers for more than 50 years now and can’t imagine a garden without them. There...

By John Silveira

Issue #81 • May/June, 2003

The weather here on the coast of Oregon is nice almost all year-round, and there almost always seems to be some kind of fishingsalmon or winter steelhead running on the Rogue, or rock cod, ling cod, halibut, cabezon, and more out in the...

Action of Second Continental Congress, July 4, 1776

When in the Course of human Events, it becomes necessary for one People to dissolve the Political Bands which have connected them with another, and to assume among the Powers of the Earth, the separate and equal Station to which the Laws...

By John Silveira

Issue #49 • January/February, 1998

It was one of those days I love. We were between deadlines and Dave, Bill, Mac, and I had gone fishing on the lake. Dave, of course, is Dave Duffy, the publisher of Backwoods Home Magazine; Bill is Dave's friend who drops in...